Analysis of the factors affecting the price difference of wire harnesses

Wiring harness price differences are affected by a variety of factors, which can be summarized into six categories: material costs, production processes, technical complexity, supply chain and market environment, certification and standards, order size, geographical factors. The following is a detailed analysis:

Table of contents

Ⅰ. Material Costs

| Classification | Specific Factors | Description | Price Impact | Typical Application Scenarios |

| Conductor Materials | Copper vs. Aluminum | Copper offers superior conductivity but is costly; aluminum is lightweight and cheaper but requires larger cross-sections to compensate for lower conductivity. | Copper wires are 30%-50% more expensive than aluminum wires. | Automotive high-voltage harnesses (copper), low-voltage harnesses (aluminum) |

| Plating Process | Tin plating (anti-oxidation) or silver plating (for high-frequency signals) increases costs. | Silver-plated wires are 2-3 times more expensive than bare copper wires. | High-frequency communication harnesses, military harnesses | |

| Insulation Materials | PVC (Polyvinyl Chloride) | Low cost, resistant to acids and alkalis, but poor high-temperature tolerance (-40℃~105℃). | Low cost, approximately ¥5-10 per meter. | Household appliances, general electronic harnesses |

| XLPE (Cross-Linked Polyethylene) | High-temperature resistant (150℃), anti-aging, but complex to process. | 20%-40% more expensive than PVC. | Automotive engine compartments, new energy high-voltage harnesses | |

| Silicone/PTFE | Excellent flexibility (silicone) or high-temperature resistance (PTFE, 260℃), but expensive. | Silicone wires cost approximately ¥30-50 per meter; PTFE wires are even higher. | Medical equipment, aerospace harnesses | |

| Sheathing Materials | Standard Rubber Sheathing | Basic protection, low cost. | Approximately ¥8-15 per meter. | Industrial machinery harnesses |

| Flame-Retardant/Waterproof Sheathing | Added flame retardants (e.g., halogen-free) or waterproof structural designs. | 30%-60% more expensive than standard sheathing. | New energy vehicles, outdoor equipment harnesses | |

| Connectors | Metal Material (Terminals) | Brass (general use), phosphor bronze (good elasticity), beryllium copper (high strength). | Phosphor bronze is 15%-20% more expensive than brass. | Automotive/industrial connectors |

| Plating Process (Terminals) | Nickel plating (anti-corrosion), gold plating (high conductivity, for signal transmission). | Gold-plated terminals are 3-5 times more expensive than nickel-plated ones. | High-frequency signal connectors (e.g., 5G equipment) | |

| Brand Differences | International brands like TE and Molex are 50%-200% more expensive than domestic connectors. | Significant brand premium. | High-end automotive, medical equipment harnesses |

▷ Key Conclusions

▪Conductor materials are the core cost driver; copper price fluctuations directly impact harness prices. Aluminum can replace copper to reduce costs but requires performance trade-offs.

▪The high-temperature and flame-retardant properties of insulation/sheathing materials significantly affect prices and must be weighed against application requirements.

▪The brand and plating processes of connectors greatly impact costs in high-frequency and high-reliability scenarios.

▶ Note: Price data in the table is illustrative; actual prices depend on market conditions

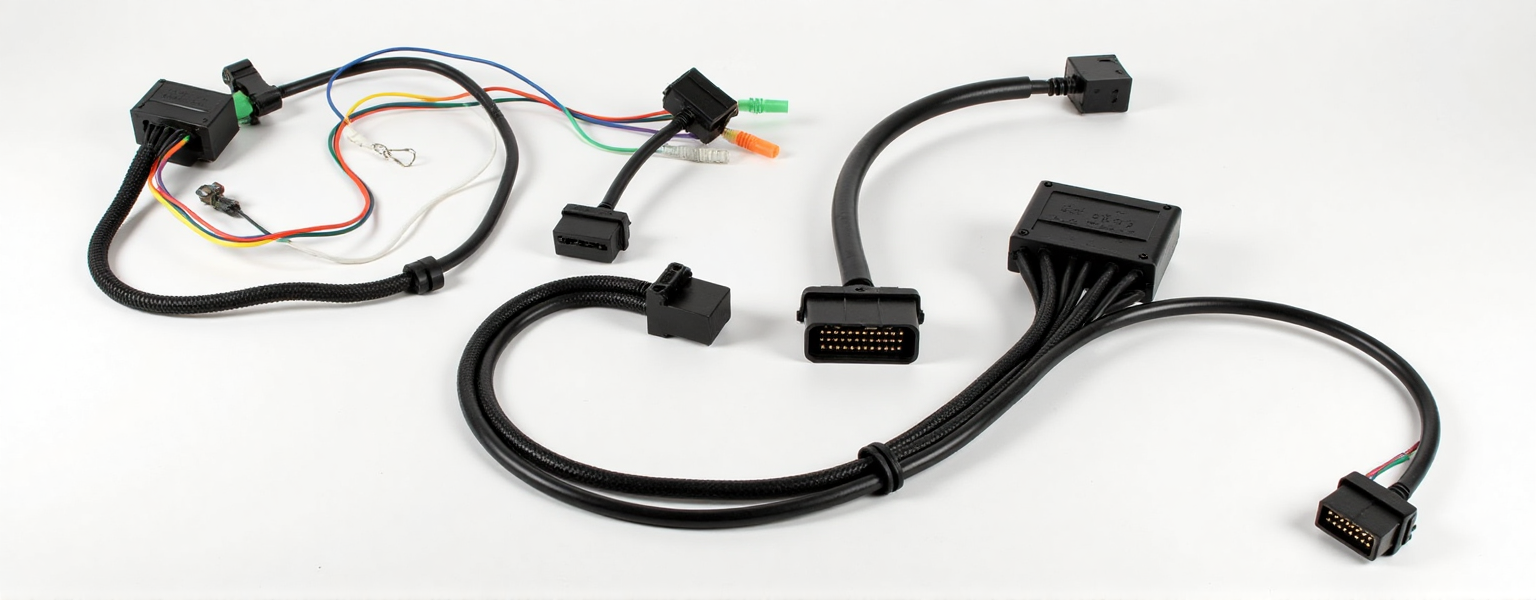

Ⅱ. Production Processes

| Classification | Specific process | Description | Price impact | Applicable scene |

| Automation Level | Full Automation | Uses automatic cutting, crimping, and inspection equipment with high efficiency (5000+ units/hour) and excellent consistency. | High initial equipment investment (millions), but lower unit cost for mass production | Automotive, consumer electronics mass production harnesses |

| Semi-Automation | Partial automation (e.g., crimping) combined with manual operations (e.g., branching and wrapping). | Cost between full automation and manual | Medium/small batch industrial harnesses | |

| Manual Production | Fully relies on manual cutting and assembly, highly flexible but inefficient (<500 units/hour). | High labor cost, small batch prices surge 50%-100% | Custom samples, military/medical special harnesses | |

| Processing Techniques | Laser Stripping | High-precision insulation removal (±0.1mm) without conductor damage, requires expensive equipment. | 20%-30% more expensive than traditional blade stripping | Precision electronic harnesses, high-frequency signal cables |

| Ultrasonic Welding | Solderless connection with high reliability, requires specialized equipment. | 15%-25% more expensive than traditional welding | New energy high-voltage harnesses, aerospace harnesses | |

| Shielding Braiding | Metal wire braiding or aluminum foil wrapping for EMI protection. | Increases material and labor costs by 30%-50% | Automotive CAN bus, medical equipment harnesses | |

| Assembly Complexity | Branching Structure | Multi-branch designs (e.g., tree-like splits) require manual or specialized equipment positioning, increasing labor hours. | Each additional branch point increases cost by 5%-10% | Complete vehicle harnesses, robotic arm harnesses |

| Waterproof Treatment | Injection molding sealing or tape wrapping with strict process requirements. | Waterproof harnesses 20%-40% more expensive than standard | New energy vehicles, outdoor lighting harnesses | |

| Inspection Methods | Visual Inspection | Low cost but high defect escape rate (~2%-5%). | Low inspection cost but high potential rework costs | Low-value harnesses (e.g., appliance wires) |

| Automated Testing (ATE) | Comprehensive continuity, insulation resistance, and high-voltage testing with 100% coverage. | High equipment investment but lower long-term costs | Automotive, medical high-reliability harnesses |

▷ Key Conclusions

▪Automation level is the key variable: Mass production prioritizes full automation for cost reduction, while small batches require accepting manual production premiums.

▪Special processes (e.g., shielding, waterproofing) directly increase costs but are necessary investments for high-reliability applications.

▪Inspection methods affect hidden costs: Automated testing requires high upfront investment but prevents post-sale risks (e.g., vehicle recalls).

▶ Note: Table data represents common industry ranges; actual values depend on production configuration and order requirements

Ⅲ. Technical Complexity

| Classification | Specific Factors | Technical Description | Price Impact | Typical Applications |

| Harness Architecture | Number of Conductors | Each additional conductor requires extra space and connection points, with complexity increasing exponentially (50 vs 500 conductors) | Cost increases 15%-25% per 100 additional conductors | Household appliance harnesses (20 conductors) vs luxury vehicle harnesses (1500 conductors) |

| 3D Routing Design | Requires consideration of mechanical movement space (e.g., door hinges), using flexible conduits and special fixtures | 30%-50% more expensive than flat routing | Industrial robot joint harnesses | |

| Signal Types | Mixed High/Low Voltage Wiring | High voltage (>60V) and signal lines (<5V) require layered isolation, adding shielding and insulation requirements | 40%-60% more expensive than single-type wiring | New energy vehicle battery management system harnesses |

| High-Frequency Signal Transmission | Requires impedance matching (±5Ω), twisted pair or coaxial structures to reduce signal attenuation | 2-3 times more expensive than standard harnesses | 5G base station RF harnesses | |

| Environmental Adaptability | Extreme Temperature Resistance | Requires silicone insulation/nickel-plated terminals for -40℃~150℃ operation, doubling material costs | 50%-80% more expensive than standard temperature harnesses | Spacecraft external harnesses/automotive engine bay harnesses |

| Chemical Corrosion Resistance | Acid/alkali-resistant materials (e.g., PTFE) + sealed connectors with strict process requirements | 60%-100% cost increase | Chemical equipment monitoring harnesses | |

| Special Functions | Self-Diagnostic Harnesses | Integrated fiber optics or smart sensors for real-time breakage/aging monitoring | 3-5 times more expensive than traditional harnesses | Premium new energy vehicle main harnesses |

| Flex Life | Ultra 100,000+ bend cycles require high-elasticity conductors (e.g., stranded copper) + special sheathing | 70%-90% more expensive than fixed-installation harnesses | Industrial robotic arm harnesses | |

| Integration Level | Modular Design | Plug-in sub-assembly structures reduce installation difficulty but increase mold development costs | 20% higher upfront cost but 50% lower maintenance cost | Modern vehicle pre-assembled harness modules |

| Wire Gauge Variation | Single harness contains multiple specifications (0.13mm² signal wires to 50mm² power wires), requiring frequent equipment adjustments | 8%-12% cost increase per additional wire gauge specification | Construction machinery control harnesses |

▷ Key Conclusions

▪Architecture complexity is the fundamental variable: Conductor count and 3D layout directly affect material usage and tooling costs.

▪Signal integrity requirements create significant premiums: High-frequency/mixed-signal harnesses require specialized materials and simulation design.

▪Environmental ratings determine material limits: Each protection level increase (e.g., IP67→IP69K) adds over 30% to costs.

▪Smartization trend drives price increases: Diagnostic-enabled harnesses are penetrating from luxury to mainstream markets.

▶ Note: Table data represents common industry ranges; actual values depend on production configuration and order requirements

Ⅳ. Supply Chain and Market Environment

The price of wiring harnesses is not only affected by technical and production costs, but external factors such as supply chain stability, raw material market fluctuations, and changes in industry demand are equally critical. Here is a detailed analysis:

| Category | Specific Factor | Description | Price Impact | Typical Case |

| Raw Material Supply | Copper/Aluminum Price Fluctuations | Copper accounts for 30%-50% of harness costs, with international prices significantly affected by futures markets, mine output, and geopolitics. | A 10% increase in copper prices raises harness costs by 3%-5%. | Copper price surge in 2021 led to 15%+ harness price increases. |

| Plastics (PVC/XLPE) | Petroleum derivatives influenced by crude oil prices and chemical production capacity. | A $10/barrel oil price increase raises insulation material costs by 5%-8%. | Plastic shortages triggered by the 2022 Russia-Ukraine conflict. | |

| Supply-Demand Relationship | Cyclical Industry Demand | Peak production seasons (e.g., “Golden September, Silver October” in automotive) drive up harness demand, with premiums of 10%-20% during shortages. | Peak season prices are 10%-15% higher than off-season. | Temporary price hikes for new energy vehicle harnesses in Q3 2023. |

| Substitute Material Competition | Alternatives like aluminum replacing copper or fiber optics replacing signal wires alter supply-demand dynamics. | Prices drop by 15%-30% as substitution technologies mature. | Data centers gradually adopting fiber optics to reduce copper demand. | |

| Supply Chain Risks | Transportation Costs | Fluctuations in shipping costs (e.g., Shanghai-Europe routes) and land transport fuel surcharges. | A 100% increase in freight costs raises delivered harness costs by 2%-3%. | Container shortages in 2020 doubled logistics costs. |

| Geopolitical Factors | Tariffs (e.g., U.S.-China trade war), conflicts (Red Sea crisis), and disruptions to key raw materials (Ukraine harness factory shutdowns). | Sudden cost increases of 5%-15%. | Ukraine factory shutdowns in 2022 impacted BMW, Benz, and Audi deliveries. | |

| Regional Policies | Localization Requirements | Countries like India/Thailand mandate local procurement ratios for auto parts, otherwise imposing additional tariffs. | Non-localized production increases costs by 10%-25%. | Tesla’s Mexico factory localizing harness production. |

| Environmental Regulations | EU REACH regulations restrict hazardous substances, increasing testing/alternative material costs. | Compliant harnesses are 8%-12% more expensive than standard products. | Halogen-free harness mandates in 2024. | |

| Industry Concentration | Oligopoly | The top 3 harness suppliers (Yazaki/Sumitomo/Aptiv) hold 60% of the automotive harness market, giving them strong pricing power. | Monopolized markets are 5%-10% more expensive than competitive markets. | Japanese automakers struggle in annual harness price negotiations. |

| Regional Industrial Clusters | Dense harness supplier networks (e.g., Kunshan/Suzhou in Yangtze River Delta) reduce logistics/collaboration costs. | Procurement costs are 3%-7% lower in industrial clusters. | NIO’s Hefei factory harness supply ecosystem. |

▷ Key Conclusions

▪Raw materials dominate cost elasticity: Copper/plastic price fluctuations require long-term futures hedging mechanisms.

▪Geopolitical risks become normalized: Diversified supply bases (e.g., Southeast Asia + Eastern Europe) are necessary.

▪Policy arbitrage opportunities: Leverage free trade agreements (e.g., RCEP) to reduce tariff costs.

▪Supply-demand game strategies: Sign “copper price linkage clauses” with OEMs (e.g., renegotiate if copper exceeds $9000/ton).

▶ Data sources: CRU International Copper Association, IHS Markit Automotive Supply Chain Report

Ⅴ. Order Volume

Order volume is one of the key factors affecting wiring harness prices, mainly reflected in economies of scale, production setup cost allocation, and supply chain bargaining power. Below is a detailed analysis:

Impact of Order Volume on Wiring Harness Prices

| Category | Specific Factor | Description | Price Impact | Typical Case |

| Economies of Scale | Fixed Cost Allocation | One-time costs such as mold development and equipment debugging can be allocated across large-volume orders. | Doubling order volume reduces unit price by 8%-15%. | Tesla Model 3 harnesses achieve 20% cost reduction through scale. |

| Bulk Material Purchase Discounts | Purchasing raw materials like copper/plastics in bulk can secure discounts of 5%-12%. | Material costs decrease by 7%-10% for orders over 100,000 meters. | Huawei’s centralized procurement strategy for base station harnesses. | |

| Production Setup Costs | Small-Batch Production | Non-value-added time (e.g., line changeovers, manual scheduling) can account for up to 30% of total time. | Unit price for orders below 1,000 pieces is 2-3 times that of large-volume orders. | Custom small-batch harnesses for military applications. |

| Minimum Order Quantity (MOQ) | Some high-end connectors/materials have MOQ requirements; failure to meet them incurs additional fees. | Costs increase by 15%-25% if MOQ is not met. | Procurement of specialized connectors for automotive Ethernet harnesses. | |

| Production Scheduling Flexibility | Rush Orders | Standard lead time is 8 weeks vs. 2 weeks for expedited orders, which require premium pricing. | Shortening lead time by 50% increases prices by 20%-30%. | Automakers’ last-minute replenishment of harnesses before new model launches. |

| Off-Season Orders | Utilizing idle production capacity can secure price discounts of 5%-8%. | Procurement costs are 5%-10% lower during off-seasons. | Home appliance companies stockpiling harnesses in Q1. | |

| Supply Chain Collaboration | Long-Term Framework Agreements | Annual committed purchase volumes secure price locks of 3%-5%. | Protects against raw material price fluctuations during the agreement period. | BYD’s three-year supply agreement with Aptiv. |

| Modular Design Reuse | Harness commonality across vehicle platforms (up to 70%) reduces new project development costs. | Platform-based harnesses are 30%-40% cheaper than all-new designs. | Standardization of harnesses for Volkswagen’s MQB platform. | |

| Logistics Optimization | OEM JIT Delivery | Direct supply to production lines on a daily/weekly basis increases logistics management complexity. | JIT mode is 3%-5% more expensive than traditional warehousing and distribution. | Toyota’s lean production harness supply system. |

| Cross-Border Bulk Shipping | Full-container shipping (40HQ) is over 60% cheaper than air/less-than-container-load (LCL) shipping. | Logistics costs account for <2% of total costs for sea shipments over 10 tons. | Mexican harness factories exporting to US automakers. |

▷ Key Conclusions

▪Critical Point Effect: The automotive harness industry typically considers 50,000 units/year as the threshold for economies of scale, beyond which marginal costs drop sharply.

▪Flexible Pricing Strategies:

- Tiered pricing (e.g., ¥50/unit for 1-5k units, ¥35/unit for 50k+ units).

- Bundled orders (e.g., high-voltage + low-voltage harnesses combined for an additional 3% discount).

▪Hidden Cost Management: Small-batch orders require special attention to:

- Engineering change fees (~¥5,000 per drawing modification).

- Sample testing fees (EMC testing costs ¥8,000-15,000 per test).

▶ Note: Data based on 2024 China automotive harness industry research, exchange rate: 1 USD = 7.2 CNY

Ⅵ. Regional Factors

Significant variations in wiring harness prices exist across different regions, primarily influenced by labor costs, supply chain infrastructure, tariff policies, and industrial clusters. Below is a detailed analysis:

Impact of Regional Factors on Wiring Harness Prices

| Category | Specific Factor | Description | Price Impact | Typical Case |

| Labor Costs | Developed vs. Emerging Markets | Hourly wages: 25 −25−40 (US/Germany), 4 −4−8 (China), 2 −2−5 (Vietnam) | European/American harnesses 30%-50% more expensive than Asian counterparts | Mercedes-Benz harness costs higher in German factories vs. Chinese OEMs |

| Automation Penetration | Japanese firms achieve 80%+ automation (labor<10%), while Southeast Asia still relies on manual labor (labor>30%) | High-automation regions see 8%-12% lower total costs | Yazaki Thailand’s robotic crimping production line | |

| Supply Chain Infrastructure | Localization Rate | Yangtze River Delta’s concentrated harness suppliers enable complete raw material procurement within 5km | Industrial clusters reduce procurement costs by 5%-8% | Tesla’s Shanghai Gigafactory harness support ecosystem |

| Cross-Border Logistics | Shipping costs: €0.15/kg (Eastern Europe-Germany), $0.11/kg (Mexico-US), €0.32/kg (China-Europe) | Long-distance transport adds 3%-7% costs | Polish harness suppliers’ advantage serving German Volkswagen | |

| Tariff Policies | Free Trade Agreements | Mexico-US harness exports at 0% tariff vs. 25% on Chinese products | Tariff differentials create 15%-30% final price gaps | US automakers shifting procurement to Mexico |

| Localization Requirements | India’s “Make in India” policy mandates 70%+ local content for auto parts, with 10% penalty tax | Imported harnesses 8%-15% more expensive than locally produced | Suzuki India’s harness localization initiative | |

| Energy Costs | Industrial Electricity Rates | €0.23/kWh (Germany) vs. €0.08/kWh (China) vs. €0.05/kWh (Vietnam) | Energy-intensive processes (e.g. injection molding) show 10%-20% cost differences | French automaker relocating harness production to Morocco |

| Industrial Clusters | Specialized Division of Labor | Jiangsu Kunshan (connectors), Zhejiang Yueqing (cables), Guangdong Dongguan (plastics) form complete industrial chains | Industrial synergy reduces comprehensive costs by 6%-9% | Huawei’s Dongguan campus harness ecosystem |

| Technology Spillover Effects | Mexico’s “Harness Belt” along US border adopts Japanese automakers’ technical standards | Learning curve reduces new project development costs by 20% | Toyota’s Mexico harness production hub | |

| Geopolitical Risks | Trade Barriers | US-China trade war increased US retail prices of Chinese harnesses by 18% | Political factors may cause sudden 10%-25% cost increases | Southeast Asia sourcing during Trump administration |

▷ Key Conclusions

▪Cost Center Migration:

- Pre-2010: China’s coastal areas (¥1,500/month labor)

- Post-2020: Vietnam (¥1,200/month) + Mexico ($400/month)

- Future trend: India (¥900/month) + North Africa ($300/month)

▪Optimal Location Selection Model:

\text{Total Cost} = \left(\frac{\text{Labor Cost×30\% + Material Cost×45\% + Logistics/Tariffs×25\%}}{\text{Localization Coefficient}}\right)

▶ Note: Localization coefficient=1.0-1.3, depending on industrial cluster maturity

▪Strategic Responses:

- Short-Chain Supply: Establish plants within 300km of customers (e.g. BYD Hefei plant serving NIO)

- Tariff Arbitrage: Leverage ASEAN-China FTA (harness tariffs reduced from 10%→0%)

- Technology Anchoring: Establish R&D centers in industrial clusters (e.g. Aptiv Suzhou Technical Center)

▶ Data sources: World Bank 2024 Manufacturing Report, China Customs Import/Export Statistics

表示できるコメントはありません。

コメントする